Surety Bonds: The Backbone of Business Agreements and Legal Protection

Surety Bonds: The Backbone of Business Agreements and Legal Protection

Blog Article

What Are Surety Bonds and Why Do They Matter?

In today’s business and legal world, trust is essential but not always enough. That’s where surety bonds come into play, offering a formal guarantee that obligations will be met. A surety bond is a legally binding contract among three parties: the principal (who needs the bond), the obligee (who requires the bond), and the surety (the company providing the guarantee). These bonds protect against losses due to the principal's failure to meet their responsibilities.

Understanding the Core Purpose of Surety Bonds

One of the most important roles of surety bonds is to ensure that contractual or legal obligations are fulfilled without disputes. When a business signs a bond, the surety company assures the obligee that the principal will perform as promised. If the principal defaults, the surety covers the loss and may later recover the cost from the principal. This layered protection makes surety bonds essential in various industries, especially construction, legal, and government sectors.

Different Types of Surety Bonds and Their Uses

There are many forms of surety bonds, each designed for specific business needs and legal situations. These can be broadly classified into contract bonds, commercial bonds, court bonds, and fidelity bonds.

: Contract Bonds

Contract bonds are mostly used in the construction industry. When a contractor bids on a project, they often need bid bonds, performance bonds, and payment bonds. These surety bonds ensure that the project will be completed according to the agreed terms, and all workers and suppliers will be paid.

: Commercial Bonds

These include license and permit bonds required by government agencies for certain businesses. For example, car dealerships, mortgage brokers, and freight brokers may need these surety bonds to operate legally.

Court Bonds

Used in legal proceedings, court bonds include appeal bonds, guardian bonds, and probate bonds. These surety bonds guarantee compliance with court orders and legal responsibilities.

Fidelity Bonds

These protect companies against losses due to employee dishonesty or fraud. While not technically considered surety bonds, they operate in a similar fashion by providing financial security.

Why Surety Bonds Are Essential for Construction Projects

The construction industry is one of the largest users of surety bonds, mainly because of the high-risk nature of large-scale projects. These bonds guarantee that contractors fulfill their obligations, protecting project owners from financial loss. Without surety bonds, many public works and commercial construction jobs would face funding risks, delays, or incomplete work due to contractor failure.

Who Needs a Surety Bond and When?

Surety bonds are commonly required when individuals or companies enter agreements that involve legal, financial, or professional risk. Government contracts, licensed businesses, and court-appointed individuals often cannot operate without surety bonds. For example, a new auto dealership applying for a license must show proof of bonding. Similarly, a guardian managing someone else’s assets must often provide a bond to ensure proper conduct.

How Surety Bonds Differ from Insurance Policies

Although both serve as risk management tools, surety bonds are different from insurance. Insurance protects the policyholder, while surety bonds protect the obligee (third party). In a bond, if the principal fails to perform, the surety pays the claim but then seeks reimbursement from the principal. This makes surety bonds more about credit than risk transfer, which is a major difference compared to traditional insurance.

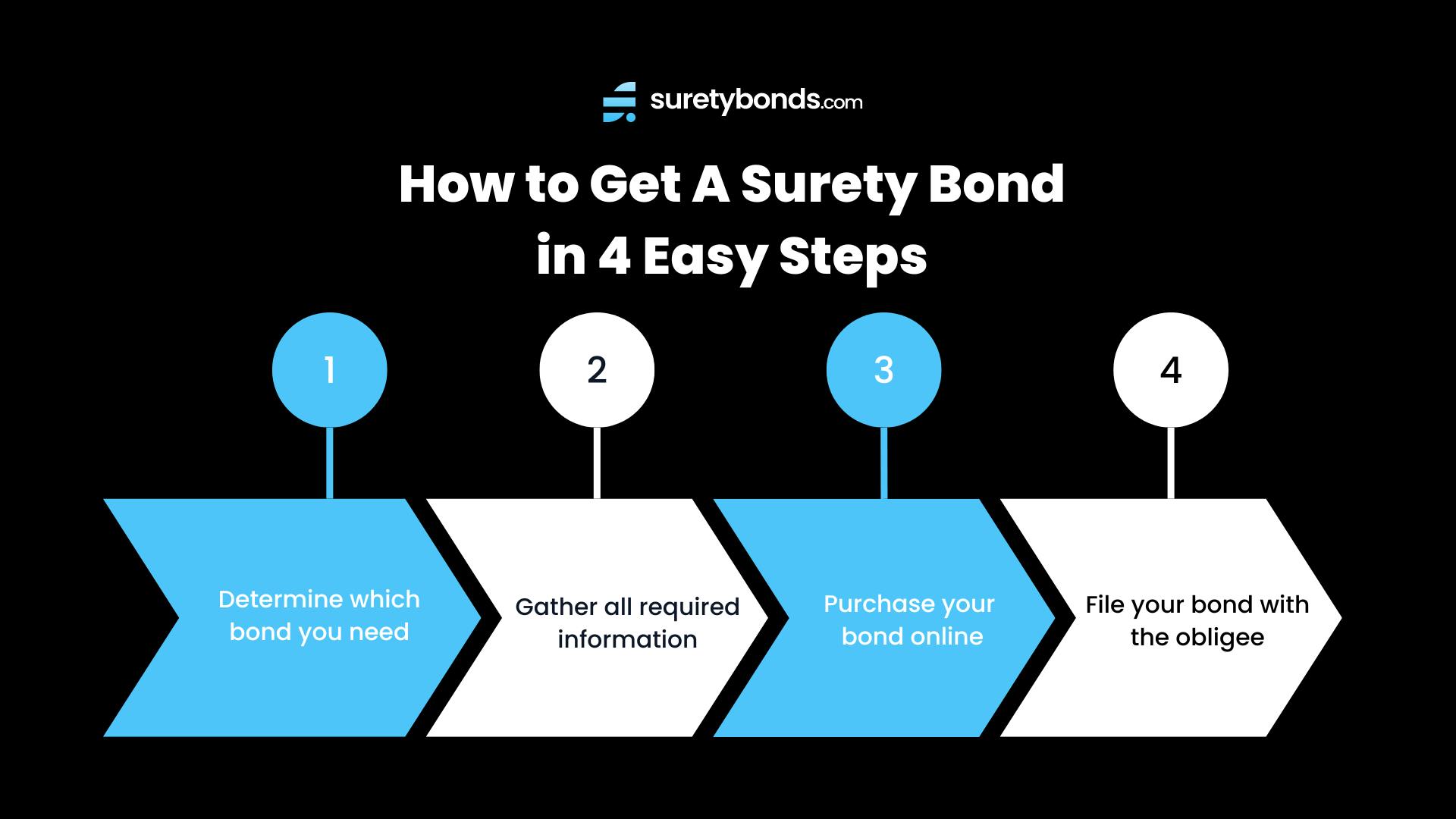

How to Apply for a Surety Bond

Getting a surety bond involves a straightforward application process, but the approval depends heavily on the applicant’s creditworthiness, financial strength, and past business performance. Typically, to obtain surety bonds, you need to submit personal and business financial statements, project history, and licensing documents. Once the surety reviews and approves your application, you pay a premium, usually a small percentage of the bond’s total value.

Cost Factors That Affect Surety Bond Pricing

The cost of surety bonds varies based on several factors including bond type, required coverage amount, the applicant's credit score, and industry risk. High-risk bonds or those required in industries with a history of defaults may have higher premiums. A person with good credit might pay 1% of the bond amount, while someone with poor credit could pay up to 15%. Shopping around and maintaining good financial health can significantly reduce your bond cost.

Risks Involved in Not Having Surety Bonds

Operating without required surety bonds can lead to serious consequences. Businesses may lose their licenses, face lawsuits, or be unable to bid on contracts. In court-related cases, lack of bonding can result in legal penalties or loss of trust. The risk of financial loss or reputational damage makes surety bonds an unavoidable part of responsible and compliant operations.

How Surety Companies Handle Claims

When a claim is filed against surety bonds, the surety investigates to determine whether the claim is valid. If the principal fails to meet their obligation and the claim is legitimate, the surety will compensate the obligee and then seek repayment from the principal. This process ensures fairness and reinforces accountability among all parties involved. Timely communication and document submission can help resolve claims faster.

Surety Bonds and Business Growth

Having valid surety bonds can be a competitive advantage for businesses. Bonded businesses are often seen as more reliable and trustworthy. This can lead to better client relationships, higher contract approval rates, and long-term business growth. In many industries, bonding is not just a legal requirement but also a mark of credibility and professionalism.

Digital Transformation in the Surety Bond Industry

Technology has revolutionized how surety bonds are issued and managed. Today, many providers offer online applications, e-signatures, and digital delivery of bonds. This reduces paperwork, speeds up approval times, and improves customer experience. Businesses can now renew or manage their bonds from user-friendly dashboards, bringing efficiency to an industry that once relied on manual processing.

Global Use of Surety Bonds Across Markets

Surety bonds are used worldwide, with growing adoption in emerging markets. In the U.S., surety bonds are heavily used in public construction. Europe applies them for customs and tax compliance. In Asia and the Middle East, infrastructure projects and international trade are the major areas where bonding is required. Understanding global practices can benefit international businesses looking to expand across borders.

Common Misconceptions About Surety Bonds

Despite their importance, many businesses misunderstand surety bonds. One common myth is that they are only needed by large corporations. In truth, even small businesses in industries like cleaning, consulting, or home improvement often need bonds. Another misconception is that once purchased, a bond guarantees no liability. In reality, the principal is still fully responsible for any claims paid by the surety.

Regulations and Legal Framework Around Surety Bonds

In most countries, surety bonds are governed by government bodies that regulate who needs to be bonded and under what conditions. For example, state and federal laws in the U.S. determine which industries must comply with bonding requirements. Failure to meet these legal conditions can result in fines or suspension of operations. It's essential to understand your jurisdiction’s specific regulations regarding surety bonds.

Choosing the Right Surety Bond Provider

Not all bond providers are created equal. When selecting a surety company, look for financial stability, customer service quality, and turnaround time. Reliable providers help ensure your surety bonds are approved quickly and remain compliant with all legal requirements. Reading reviews, checking accreditation, and comparing offers can save you time and money in the long run.

Maintaining and Renewing Surety Bonds

Like licenses and insurance, surety bonds have expiration dates. It's critical to track your bond's validity and renew it on time. Some industries require continuous bonding to remain licensed, so missing a renewal can disrupt your business operations. Most sureties offer renewal reminders, but it’s always better to maintain a personal calendar to stay ahead.

Surety Bonds in the Future of Risk Management

As risk management continues to evolve, surety bonds will remain a vital tool for businesses, governments, and individuals. With more industries adopting digital verification and real-time risk assessment, bonds will likely become more tailored and transparent. This shift will make them more accessible and better aligned with the specific needs of modern business environments.

Final Thoughts: Why Every Responsible Business Should Consider Surety Bonds

Surety bonds are more than a formality — they are a powerful symbol of trust, professionalism, and accountability. Whether you’re in construction, law, finance, or any licensed trade, surety bonds protect your reputation, meet legal requirements, and open doors to more business opportunities. Choosing the right bond and provider is a smart move that pays off in stability, growth, and long-term credibility. Report this page